The student-debt crisis has been dire for years, but never more than it is right now. Under Trump’s presidency, the total amount of student loans held by Americans increased by over 16 percent to its highest level ever, an eye-watering $1.64 trillion. Federal-student-loan payments are currently frozen as part of the government’s pandemic relief, but that order expires at the end of the year, at which point 45 million Americans will resume staring down bills that average $393 per month, ready or not.

For people of color, student debt is even more insidious. Black and Latinx students borrow more money, on average, than their white peers for the same degrees, and are more likely to default or have trouble paying it back. Forgiving at least some amount of government student debt, as lawmakers like Elizabeth Warren and Chuck Schumer have proposed, could be one of the most effective ways to shrink the racial wealth gap — and boost the country’s economic recovery from the pandemic overall.

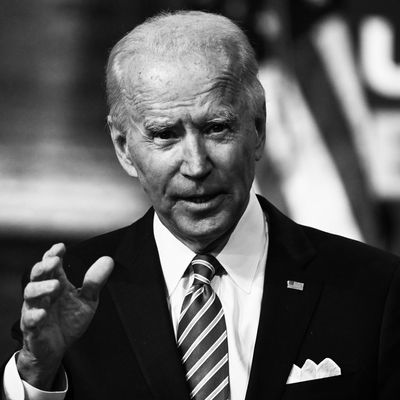

So what is Joe Biden going to do about this when he takes office in January? Quite a lot, if he can pull off his wide-ranging higher-education policy (or not enough, according to proponents of canceling student debt altogether). Here’s what he has proposed and/or supported in his plan, and how likely it is to actually happen.

Will Biden cancel student debt outright?

Probably not. Biden has voiced support for pandemic-relief legislation that would forgive $10,000 in student-loan debt across the board, but this is not the same thing as saying that he will take executive action to forgive anyone’s student loans. And even if he wanted to, there’s some debate over whether he has the legal right to do so. Many Democrats believe he does: Schumer recently said that Biden should be able to cancel student debt “with a pen as opposed to legislation.” And Warren has pointed to the Higher Education Act of 1965, which “recognizes the secretary of Education’s broad administrative authority to cancel federal student loan debt.”

If Biden does decide to circumvent Congress, he will almost certainly be blocked with lawsuits. “I very much expect that the basis of [the Higher Education Act] would be challenged in court if the Biden administration chose to go that route to forgive student debt with an executive order,” says Andrew Pentis, a certified student-loan counselor who researches student-debt policy at Student Loan Hero.

The more expeditious route, of course, would be if Congress could agree on a pandemic-aid bill with some amount of student-loan forgiveness baked in. That will probably hinge on whether the runoff elections in Georgia this January give Democrats control of the Senate.

As for that $10,000 number: It may not sound like a lot, considering that 70 percent of college graduates left school with an average debt load of $38,000 in 2017. Surveys show that only a little under a third of student-loan holders owe less than $10,000 total. But what’s notable is that this demographic also has the highest risk of defaulting. That’s because they are also less likely to have completed their studies, according to a Pew Research analysis. “There’s a lot of people who started school and were forced to take on debt, and then their studies cost more than they anticipated or life just happened, so they had to drop out and go back to the same job they had before, with the same paycheck,” says Seth Frotman, the executive director of the Student Borrower Protection Center, a nonprofit that advocates for student borrowers. “Now they don’t have a degree and the earning power that could bring with it, but they do have an extra $100 or $200 to pay in student loans every month.” In other words, a $10,000 reprieve would be a lifeline for the most strapped.

As for the $50,000 student-debt cancellation that Warren and Schumer have called for: Biden has never publicly supported this proposal.

Will monthly student-loan bills get lower?

If Biden gets his way, yes. Most people with government student loans are on an income-based repayment plan that requires them to fork over between 10 to 20 percent of their discretionary income (their take-home pay minus essential costs like housing and food) for their loans each month. But under Biden’s program, anyone who makes $25,000 or less per year will not owe any payments on their undergraduate student loans at all, and won’t accrue interest on them either. People who earn more than $25,000 will owe only 5 percent of their monthly discretionary income. And if debt holders adhere to the program and make all their payments on time for 20 years, their remaining balance will be totally forgiven. One potential wrench in this policy: For it to work, Biden may need congressional approval to change the way forgiven loans are taxed. But he might be able to wriggle around that step.

Will other programs for student-loan forgiveness become available (and will they work)?

Biden says yes, but you’re right to be skeptical: The current federal Public Service Loan Forgiveness program (PSLF), created in 2007, is a disaster. Theoretically, it allows loan holders to get their debt forgiven after a certain number of years working in public-service jobs (like at schools, nonprofits, or in government). But the program has been such a mess of red tape that only 2.2 percent of applications have been deemed eligible since it began, leaving most participants stuck with their original bills after spending years in low-paying jobs that they took under the promise of loan relief.

To fix this problem, Biden has pledged to create a simpler program that would relieve $10,000 of undergraduate or graduate student debt for every year of national or community service, up to five years. He also wants to streamline and fix the existing program so that participants can get retroactive loan relief for previous years worked.

New PSLF legislation has already been proposed in Congress, but only with Democratic support. Biden has said he wants the bill to pass, but again, that may come down to who controls the Senate come January.

What about people who got snowed by for-profit colleges or other education scams?

There’s already a law in place, known as “the borrower defense to repayment,” that allows people who were defrauded or misled by schools to apply to have their federal student loans forgiven. But the Trump administration has gutted its enforcement so thoroughly that most applications haven’t been processed for years. “There are hundreds of thousands of people who have been ripped off by predatory schools who are stuck in debt purgatory because the government hasn’t held up its end of the law,” says Frotman. “The incoming administration has a tremendous opportunity to use these existing laws to provide relief.”

Biden has promised to require for-profit schools to “prove their value” to the U.S. Department of Education (which answers to Biden directly) before gaining eligibility for federal aid. This step will hopefully weed out a lot of bad actors before anyone takes out student loans to attend their classes. And in case it doesn’t, Biden says he will return to enforcing the borrower defense rule, so that victims will be off the hook for loans they took out for worthless degrees. He can do all of this without congressional approval.

Student-loan bills are on hold. When will we have to start paying them again?

It’s unclear whether Trump will extend the current freeze on government student-loan payments when it expires at the end of the year. But if he doesn’t, Biden could reinstate it when he takes office in January, and could even backdate it to January 1, says Frotman. “If tons of federal-student-loan borrowers didn’t make a payment in those intervening 20 days, then they wouldn’t necessarily be penalized if Biden reinstates the rule,” he adds. However, Biden has not explicitly stated that he will do this, even though Trump’s precedent shows that he has the executive power to do so.

What about private student loans?

The vast majority of outstanding student debt (over 90 percent) is in the form of government loans, according to the Consumer Finance Protection Bureau. But that still leaves about $132 billion of outstanding private student loans, which people owe to banks and other lenders. “Helping borrowers with private student loans also needs to be on the table,” says Frotman. “Often people have a combination of private and government student loans, and they’re struggling with both.”

House Democrats proposed a law back in 2017 that would require private lenders to offer more affordable payment options, including bankruptcy, to people who are struggling financially. (A law passed in 2005 — which Biden backed at the time — exempts most private student loans from discharge in bankruptcy proceedings, so they’re almost impossible to get rid of.) Biden supports the new law and has admitted that the old one is a big problem, but next steps will be up to Congress.

Does Biden’s plan apply to loans for undergraduate as well as graduate school?

Mostly, yes. “The majority of Biden’s plans for student-loan relief apply to both undergraduate, graduate, and professional loans,” says Frotman.

What about people who don’t have student debt yet, but might have to take out loans in the future?

An ambitious cornerstone of Biden’s higher-education plan is to provide two years of community college or job training for free, and make public colleges and universities tuition-free for all families with incomes below $125,000. This is a big deal, and would be a major part of Biden’s legacy if he pulls it off. But it will also be an uphill battle, as it requires complex partnerships between federal and state institutions.

A more doable part of Biden’s plan involves doubling the amount of money that students can get from Pell grants, which help cover tuition for higher education for those who can’t afford it otherwise. This could be a huge help, almost immediately, to current and future students.

No matter what, Biden’s education plan faces serious roadblocks if the Senate remains in Republican control — don’t assume that any part of your loans will be canceled just yet. But relief in some form, to the people who need it most, should be available in the coming years.